What Different Commercial Contract Types Are There?

Contracts act as a legally binding agreement between parties – they ensure adequate compensation after the fulfilment of contract obligations. With so many agreements needing a contractual base, there are many different contract types used across several industries – but for the majority of commercial contracts we encounter in our clients’ day-to-day business, contracts are generally defined by the way disbursement is made.

In this article, we will be introducing 6 major types of contracts that you need to know to define your commercial relationships. They apply mainly in the services, construction and manufacturing contract space, but hopefully, these examples can give you some ideas on how to legally define your compensation structure for your business partnerships, whatever your industry!

Cost-Reimbursable/Cost Plus Contracts

Cost-reimbursable contracts are where owners pay the contractors for the actual costs incurred for the job. Additionally, an extra fee is added for contractors to profit from.

Contracts like these establish estimates of total costs for the purpose of obligating funds and setting a ceiling that the contractor may not exceed without approval.

Here, there are 3 different types of costs that should be considered:

- Direct costs. These are direct costs that contribute to creating the product or offering. These can include the costs of making a good, the labor costs, equipment rented for this function, and so on.

- Indirect costs. These are costs to keep the business operating, including office space, insurance and equipment.

- Profit. This is the markup for doing work. Generally, this consists of a percentage on the direct costs of the job.

These are usually used where:

- Nature or scope of job cannot be properly defined at the outset.

- Risks associated with the job are high.

As the final cost of the project is unknown, the owner takes on high risks when entering such contracts. Hence, the costs for which the contractor is entitled to should be clearly stated in the contract.

Pros of Cost-reimbursable contracts:

- Flexible. Owners can make design changes however they like as contractors will be reimbursed accordingly for the additional time or materials incurred. For example, the contractor won’t have to worry about the direct costs, if their pay or profit isn’t affected in the end, following contract terms.

- Impact of miscalculations at the start is not heavy.

Cons of Cost-reimbursable contracts:

- Complex cost classification. Differentiating between direct and indirect costs are difficult. Moreover, some owners explicitly state in contracts that they do not pay for indirect costs.

- Having to estimate the cost of the project upfront is difficult.

Lump Sum/Fixed Fee Contracts

In a lump sum or fixed contract, a single sum is quoted for the whole project. The naming variations largely depend on how various industries name this type of contract, with the construction industry referring to these as lump sum contracts. Others simply refer to this as fixed fee contacts.

This is generally favored in the construction industry because the contractor assumes the risk of increased performance costs. This is also preferred for smaller, repeatable projects that are simple to handle, have defined deliverables, and don’t suffer from scope creep.

It is important to note that once a fixed feed contract is signed, it is generally very difficult to obtain any credit back for an uncompleted job.

These contracts are usually adopted when:

- Risk needs to be transferred to the contractor.

- Owner wants to avoid changes in orders for undetermined work.

- A clear scope and defined schedule is negotiated and accepted.

Pros of fixed fee contracts:

- Simplifies the bidding process. This is possible because rather than having contractors submit multiple bids, a fixed total price is named. Hence, the selection process for owners is simplified.

- Potential for higher profit margins.

- Predictable costs.

As the price has been fixed ahead of time, finishing under-budget allows the contractor to pocket the savings.

Cons of fixed fee contracts:

- Miscalculations at the start could impact profit margins heavily. Since the price is set at the beginning, any unexpected setbacks or changes will eat into your profit margin.

- The larger the scale of the project, the higher the risks of losses.

- Lack of flexibility. This contract should have a well-defined scope because of the fixed sum. As such, this relationship may become inflexible to changing requirements.

Time & Materials Contracts

This is a contract type that reimburses contractors for the cost of materials and the time they spent working on the project with a mark-up for profit. An hourly or daily pay rate and mark-up is usually established ahead of time to reduce the risks taken on by owners.

These contracts are best adopted when:

- Scope of work is small or not well defined.

- Capacity and quantity of time and materials is undetermined.

- Specifications and requirements are likely to change as the project progresses.

Pros of Time & Materials Contracts:

- Relatively agile in nature. Due to the fact that costs of materials and labour hours are reimbursed by the customer, any changes and unexpected delays made will be covered.

- Provides clients with cost transparency and allows them to verify invoices to ensure costs are correct.

Cons of Time & Materials Contracts:

- Time and material tracking is time-consuming. Inaccurate logging of material costs and billable hours will affect profit margins and this time-consuming task means lesser time is spent on other tasks.

- No incentive for contractors to be efficient. Contractors are paid by the hour or day, so there is no incentive to finish projects early. Hence, a common practice is to include a bonus that encourages contractors to finish ahead of time.

Guaranteed Maximum Price (GMP) Contracts

Here, the parties agree that the contract sum will not exceed a specified maximum. If the actual cost of the works is higher than the GMP, the contractor must bear the additional costs. How any cost savings from the project will be handled should also be stated in the contract.

It is important that these GMP contracts have unambiguous wording, especially where there are pain/gain provisions. Moreover, despite the name ‘guaranteed maximum price’, clients should always ensure that they have adequate contingencies.

These contracts are used when:

- Projects have few unknowns.

- Contractor has responsibility for completing the client’s design and carrying out the construction works.

Pros of GMP Contracts:

- Risks for delivering the project are transferred from the client to the contractor.

- GMP contracts incentivize savings.

Setting a fixed price overhead in the contract encourages contractors to reduce costs and finish ahead of the schedule. As a result, owners usually agree to share cost savings with their contractors.

Cons of GMP Contracts:

- Contractors are likely to tender a higher price as they bear larger risks.

- GMP contracts can take longer time to review and negotiate as contractors want to protect themselves from exceeding the price cap.

Unit Pricing/Measurement Contracts

In unit pricing contracts, the total work required to complete a project is divided into separate units. The contractor will provide the owner with price estimates for each unit of work rather than an estimate for the project as a whole.

These contracts are best used when:

- Work is repetitive.

- Resources are easily quantifiable.

If the project requires multiple complex trades, this contract type may not be suitable due to the difficulty in accurately predicting the quantities needed for each unit.

Pros of Unit pricing Contracts:

- Easy to compare and benchmark prices for clients. With the increased transparency, owners are able to better understand each cost that goes into the final cost as each unit is predetermined. It also makes it easy for comparison with market and competitor prices.

- Profit margin remains unchanged even if more work is required. Additional work just means another pre-priced unit will be added to the total cost. This makes it easy to manage changing order and alterations to the project.

Cons of unit pricing Contracts:

- Majority of the risk lies with the owner. The units required to complete a project will not be known immediately, meaning owners may end up reimbursing costs for unexpected units that were added.

- Payment can be delayed due to remeasurement. Remeasurement refers to the owner’s ability to compare the price of each unit with the total cost of the project. This process takes time and could slow down payment from owner to contractor.

How to Manage So Many Different Contract Types

With so many different types of contracts to manage, how do you keep everyone on the same page and manage your contracts efficiently? Here are some ways:

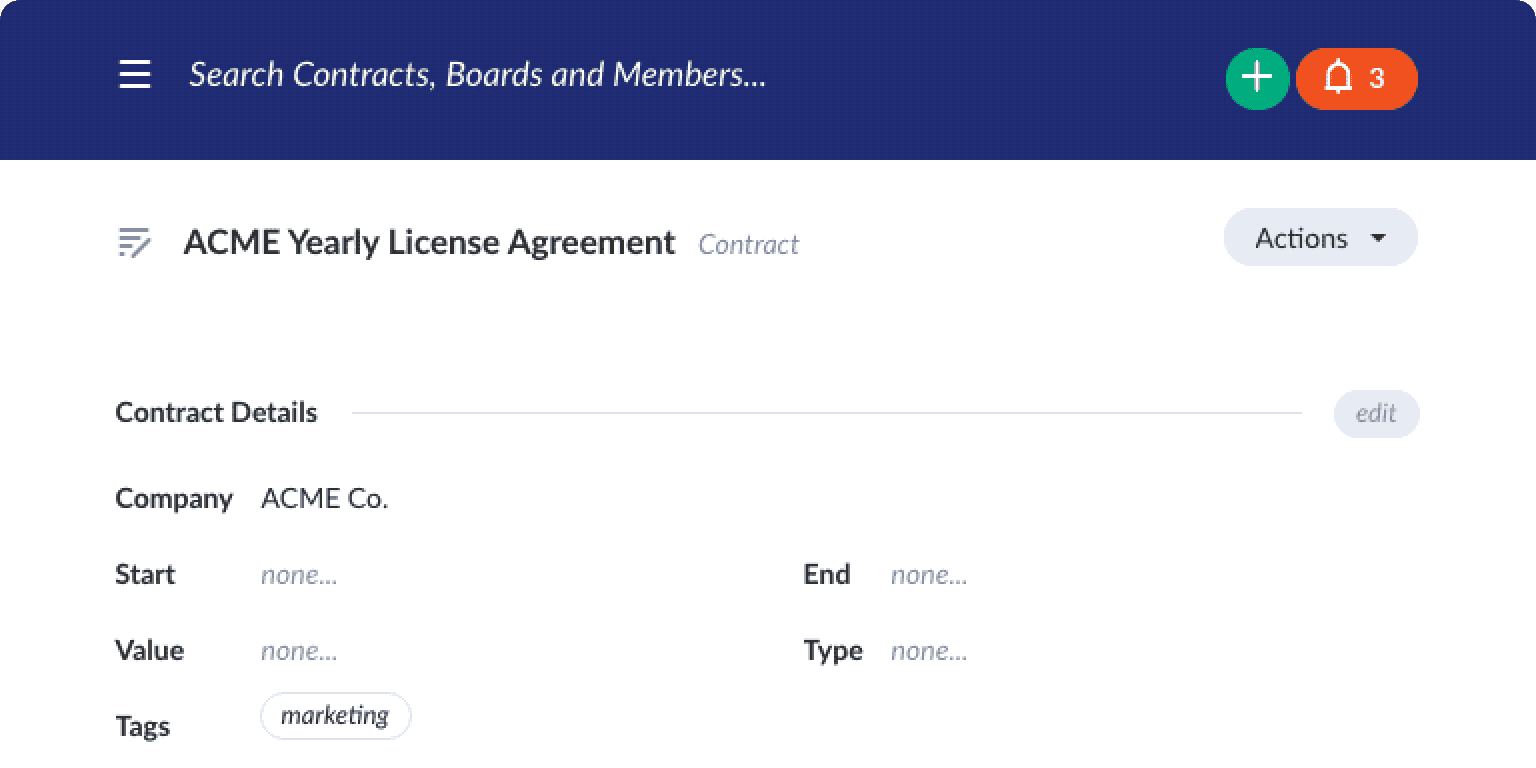

- Invest in a contract management platform. This allows businesses to automate their contract management, find contracts quickly and view details at a glance. All employees can be given access to this platform and view contracts or extract contracts with relative ease.

- Set well-defined approval workflows with defined responsibilities. The last thing that you want is to have rogue changes for sensitive documents like contracts. Set approval workflows to understand the responsibilities behind each contract.

- Set notifications and reminders. Have these on contract renewal dates to prevent overspending or delayed payments.

Have You Decided To Scale Your Contract Management Processes With Contract Hound?

Leave behind your traditional risky spreadsheet-based workflows and replace them with a more efficient system like Contract Hound now. Save your employees time and effort from having to send contract files back and forth, increasing your risks of internal miscommunication. Check out our 14-Day free trial and sign up here today.

Published

February 22, 2021

Writer

Category

Save time with

Set contract reminders with Contract Hound and you'll never lose track of a contract again. Try it FREE for up to 10 contracts.

Never Lose A Contract Again

Never lose track of a contract!

Start Your Free Trial Today.

Disclaimer

The contents of this website do not constitute legal advice and are provided for general information purposes only. You should seek appropriate legal advice before taking or refraining from taking any action based on the contents of this website. We accept no responsibility for any errors, omissions or misleading statements on this website, or for any loss which may arise from the use of information contained on this website.